Nestled in the heart of Roseville, California, Harry Crabb Park is a hidden gem offering…

CalHFA Dream For All 20% Down Payment Assistance

CalHFA Dream For All 20% Down Payment Assistance

The Dream for All down payment assistance program is designed for First Time Home Buyers and is aimed to assist with 20% of the down payment in an equity share program. The purpose of Dream For All home loan and assistance program is to assist home buyers with home affordability and down payment resulting in an increase in homeownership. The assistance program is not a grant but rather a loan that has to be repaid along with a shared equity clause.

Benefits of the California Dream For All Assistance Program:

- Much lower monthly payments due to having no PMI or reduced PMI (Private Mortgage Insurance)

- Much Lower monthly payment due to lower financed loan amount

- Increased buying power due to larger down payment and lower qualifying payment

- The 20% down payment assistance has NO MONTHLY REPAYMENT

- No repayment of the assistance is required until transfer of the property

- Make a stronger offer with a larger down payment

- Get a competitive rate on your 1st mortgage

- Ability to a 1-time refinance to lower your rate and payment even further

- No repayment necessary if property is ever turned into a rental property

Repayment of the Dream For All Assistance Loan

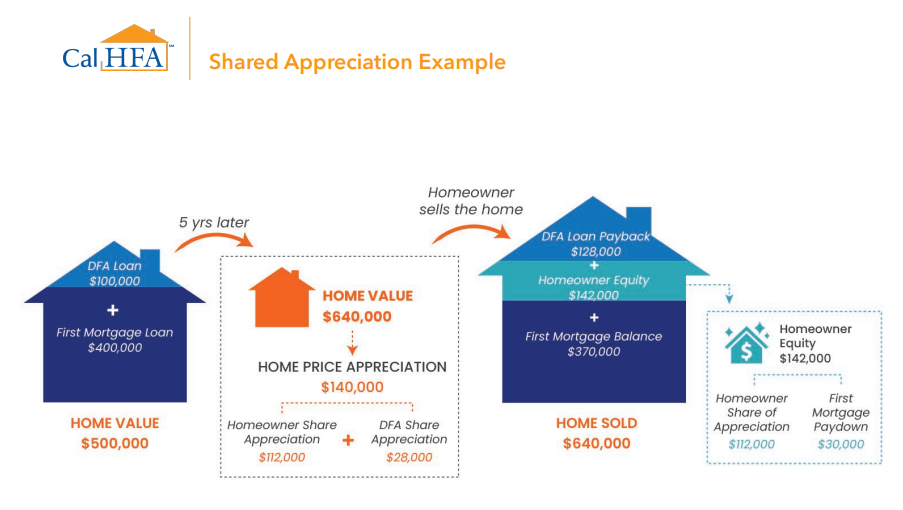

Repayment of the loan will be triggered upon sale, transfer of the home, or if the borrower refinances with a cash out loan. The homeowner will repay the original down payment loan, plus a share or percentage equal to the assistance percentage of the home appreciation. This amount is calculated by taking the Sales price minus the purchase price of the original home purchase.

What does Shared Appreciation Mean?

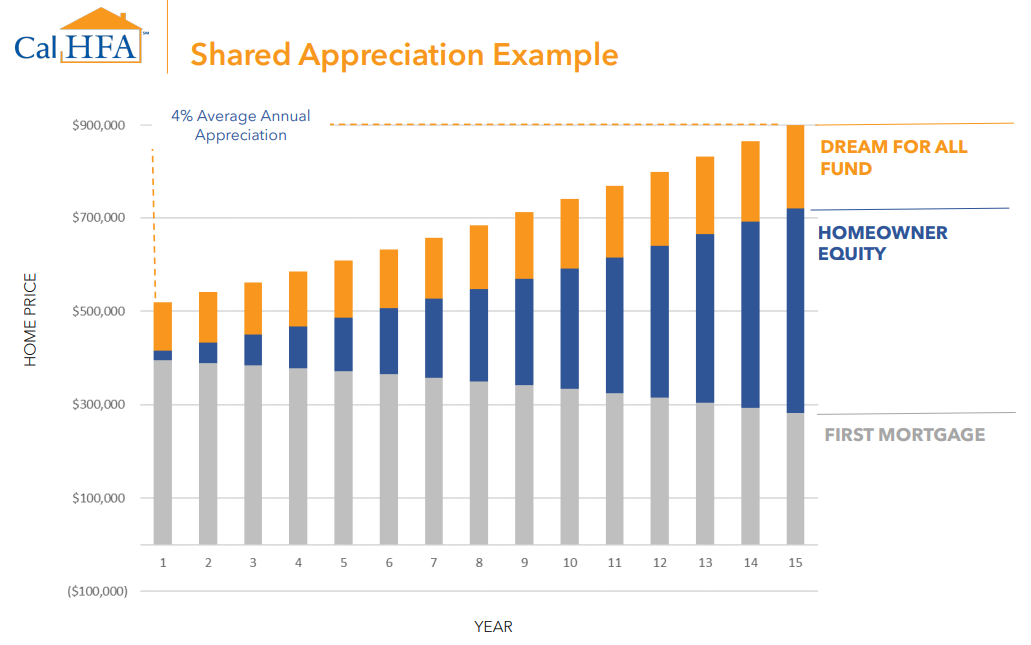

Shared appreciation or also known as shared equity, means the homeowner will share a percentage of the GROSS Profits with CalHFA at time of sale. Think of it as going into a partnership with CalHFA. You gain by getting up to a 20% down payment assistance loan without any monthly interest or repayment saving you tens of thousands of dollars in interest, and as a cost of this partnership, CalHFA wants up to 20% (matching original contribution) as a repayment at time of sale along with the original down payment. This will allow many homeowners the opportunity to achieve homeownership with a much stronger offer and a much lower payment.

How Much Appreciation is Shared with CalHFA?

The percentage of appreciation that is split or shared with the state housing authority when you sell or refinance depends on what your income is.

Borrowers with income between 80% to 150% of the AMI as set by Fannie Mae keep 80% of the home appreciation and pay 20% of the Gross Appreciation to CalHFA with the initial contribution from CalHFA being 20%.

Borrowers with income under 80% AMI will keep 85% of the home appreciation and pay 15% back to CalHFA with the original contribution from CalHFA being 15%.

Shared Appreciation Cap Calculation

Appreciation is capped at 2.5 times the original principle loan amount. So on a $500k home purchase with $100k aka 20% Assistance, 2.5 x $100k = $250k max equity share. The homeowner would have to pay back $250k equity share along with the original $100k loan.

Below is what a $500,000 purchase might look like if a moderate-income homeowners sells after 5 years.

Dream For All Eligibility & Qualifying Requirements:

- To qualify for the Shared Appreciation Loan at least One borrower must be a first-generation homebuyer.

- A first-generation homebuyer is defined as a homebuyer who has not been on title, held an ownership interest or have been named on a mortgage to a home (on permanent foundation and owned land) in the United States in the last 7 years, AND;

- To the best of the homebuyer’s knowledge whose parents (biological or adoptive) do not have any present ownership interest in a home in the United States or if deceased whose parents did not have any ownership interest at the time of death in a home in the United States, OR;

- An individual who has at any time been placed in foster care or institutional care (type of out of home residential care for large groups of children by non-related caregivers).

- All borrowers must be first-time homebuyers.

- To know for sure, you should understand that a first-time homebuyer is defined as someone who has not owned and occupied their home in the last three years, and who has not lived in a home owned by a spouse in the past three years. If any of these circumstances happened more than 3 years ago or you have never owned a home, you can apply for the benefits of CalHFA’s first-time homebuyer programs.

- Income must be at or below 120% of the Area Median Income for the county you are purchasing in.

- Minimum Credit Score: 660

- Maximum Debt-to-Income Ratio: 45% with a score of 660-699 / 50% with a 700+ credit score

- Property Type: SFR or Condo – no multi family allowed at this time but there’s talks regarding allowing duplexes

- Min/Max CLTV: 70%/105%

- Non-occupied co-signers not allowed

- Cannot Exceed County Income Limit

- CalHFA homebuyer education course required along with Dream For All education

- One year home warranty required

- Cannot be combined with CalPLUS ZIP or MyHome Assistance

Can I ever refinance?

CalHFA agrees to allow a one time refinance into a lower rate and payment. A cash-out refinance or any other loan terms (such as higher rate, ARMs, etc) that are not for the betterment of the loan terms, will trigger repayment of the 20% initial down payment assistance loan along with the 20% home appreciation.

Who has to take this Homebuyer Education and Counseling course?

Only one occupying first-time borrower on each loan transaction.

How do I take this education and counseling course?

- Take the 1-hour California Dream For All education course which covers what shared appreciation is and how it affects your mortgage repayment. This course is delivered online and is free. Visit calhfadreamforall.com to get signed up and learn about shared appreciation now.

Next Steps in Applying

It’s important you contact us to see if you qualify and would benefit from this loan program. Please fill out the form below and one of our Dream Specialists will reach out to you.

***We are not part or affiliated with CalHFA. We are an approved Mortgage Broker able to offer the program through CalHFA***